Nissrine Fessikh

27-10-2021 8 min readFive pandemic trends that will shape the future of online payments

Digital payments have weathered the disruption of COVID-19, not least because cash has lost its appeal, older consumers have embraced online shopping and many people are looking for new ways to save money.

These trends were described by Jim Magats, svp/omni Payments at PayPal - which has digital payment tools including its eponymous platform for consumers and merchants, the Venmo peer-to-peer application, and the Honey virtual coupon service - at the RBC Financial Technology Conference.

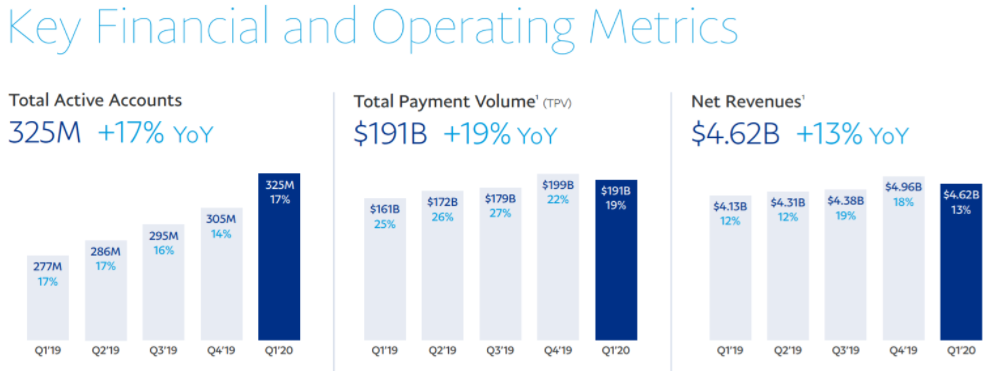

PayPal currently has 325 million users in its portfolio, from individuals to e-commerce sites and physical shops, giving it a broad view of changing behaviors.

Drawing on insights from this huge user base, Magats identified the following changes that could have a lasting impact beyond the immediate health and economic crisis:

Cash erosion

A key outcome of the pandemic, Magats argued, is the "new erosion of cash" - suggesting that an earlier development is likely to accelerate due to hygiene issues in physical shops and the concomitant shift to e-commerce.

While the scale of the pandemic makes it difficult to draw parallels, he pointed to a demonetization program that occurred in India in November 2016, when the country withdrew Rs500 and Rs1,000 notes - representing 86% of currency in circulation at that stage. The move, he explained, was aimed at combating problems such as the spread of counterfeit notes and simultaneously led to an increase in digital payments.

The past four months, complete with blockades and shop closures, means "a moment of demonetization has happened globally," said Magats. "And, so, it's just kind of a tidal wave of incredible inertia right now in the digital payments space."

Corroborating this is the 25 million merchant customers who use PayPal - a figure that could rise by a million in this quarter alone as more and more businesses look to leverage its services.

Older consumers are embracing digital payments

The early adopters of digital payments - as with many new technologies - are young, savvy online consumers.

But PayPal's breakdown of new active users indicates that a "higher percentage of people aged 50 and over" are now using these tools to make transactions, send and receive funds, and access virtual coupons, among a variety of digital services.

The growth of this audience, for Magats, indicates that "people who were reluctant to want to use digital payments have become more comfortable with cash and cheques and have now realized that this can be another way to manage and move money."

While several US states are relaxing blockades, PayPal has found that the use of its tools remains strong among this cohort. Magats' working hypothesis is that COVID-19 may have pushed laggards to experiment with online payment tools - but in doing so, they are now interested in the benefits.

Separating purchase and payment

Other changes in buying habits include decoupling the purchase from the flow of money between the parties. "I think we are seeing a kind of idea of separation of purchase and payment emerge," explained Magats.

As evidence, he cites:

- A range of comparison sites and shopping bots that allow consumers to enter the item they want to buy and see where it is available online - and at what price.

If a customer is interested in buying a pair of high-end trainers, for example, they can submit the details in a platform's search bar or chatbot interface, and generate ads on the web.

"It's almost like the emergence of a demand trend [that is] driven by a consumer in an open market for merchants to respond effectively to that demand," said Magnets.

Buyers can even set their price criteria and exclude any ads that exceed what they are willing to pay. In this environment, merchants are "essentially competing to fill that order.

- PayPal and its competitors are creating flexible payment tools through which people can "decide how they want to pay once the transaction is complete," Magats continued.

Under this model, a buyer might have initially purchased shoes with a credit card but might want to change and pay with another card, app, or other online option. Monthly payment options are also on the rise, the PayPal executive noted.

In this reformulated purchase funnel, pre-planning a purchase, searching online, and choosing a payment method becomes "three different things we see everywhere," he continued.

- In late 2019, PayPal announced a $4 billion acquisition of coupon company "Honey", a web browser add-on that automatically applies coupon codes to potential purchases.

Such "large-scale couponing," Magats said, is vital in a time of economic stress for many shoppers. And the main benefit for online retailers could be a reduction in the number of abandoned purchases once goods have been placed in a virtual shopping cart - a figure estimated at around 50%.

Contactless payments are becoming increasingly important

In this context, contactless payments are likely to be "critical from a physical world perspective", as anxiety about cleanliness is widespread.

Some of the possibilities here are:

- Contactless debit/credit cards, as is the case with Venmo branded cards.

- Near Field Communication, which uses Bluetooth technology to enable information exchange between digital devices over short distances.

- QR codes are unique digital tags that can be attached to individual locations or products and then scanned with a mobile phone to gather more information or make a purchase.

For its part, PayPal has launched QR code functionality in 28 markets - including the UK, Hong Kong, and the US - which allows small merchants to print these tags for use, for example, at a food truck or farmers' market. Buyers can open the PayPal app, scan the black and white badge, enter the amount they want to pay, and immediately send their money to complete the transaction.

Beyond small "casual" sellers, PayPal believes QR codes could be common in restaurants, pharmacies, and grocery shops. Similar optimism prevailed when the technology first emerged, but Magats proposed that several factors could lead to significant adoption in 2020 and beyond.

One case in point involves the online purchase of in-store pick-up services which, like COVID-19, have led to restrictions on physical purchases. The main task here is to 'match' who has ordered a product via an e-commerce site with the person picking it up - an area where QR codes can play a transparent and socially remote role.

Showrooming" is making a comeback

Just as QR codes are making a comeback, another concept from the early days of online retailing could be back. This idea is "showrooming", where physical shops become a place to look at physical goods before buying them online. A customer interested in buying a pair of Air Jordan trainers, for example, might check them out in a shop, then decide to "search the Internet for those particular offerings and look for people to buy them for you," he said.

This is a particularly important trend that will change the way e-commerce and payment systems work.

Don't miss any news, subscribe now!

Related articles

Publications recommandées