Nissrine Fessikh

05-11-2021 6 min readDigital Trends 2021 : Retail in the spotlight

It is clear that the year 2020 has been a complicated one for many traditional retailers, as social distancing and containment measures have led to a drop in attendance, if not a complete lack of attendance.

After a long period of uncertainty, many are still in survival mode. On the positive side, online retailing has grown significantly, driven by the growth of e-commerce, and omnichannel retailers who are quickest to adapt to changing consumer habits have been able to take advantage of new opportunities. With digital touchpoints now an integral part of the customer journey, retailers that have shown agility and innovation during this pandemic period are emerging stronger and more sustainable than ever.

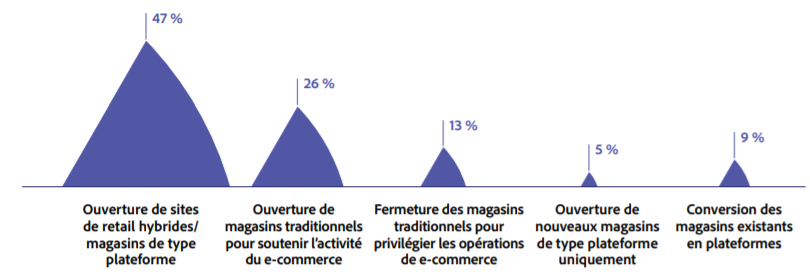

In the U.S. market, for example, where e-commerce penetration had been growing steadily at about 1% per year for the past decade, digital retail's market share suddenly jumped to 33% within weeks in 2020/2021. This growth impacted holiday sales, which topped $188 billion, a 32% increase over the same period in 2019, according to Adobe data. With consumers increasingly convinced to buy online, retailers who traditionally run brick-and-mortar stores need to adopt an omnichannel approach to keep in touch with their customers, who are less likely to visit a store. The Econsultancy/Adobe Digital Trends 2021 survey reveals that the primary physical store location strategy for nearly half (47%) of omnichannel retailers this year will be to open hybrid spaces that meet the needs of both online and in-store shoppers.

Percentage of the company's best physical store location strategy for 2021.

Hybrid retail strategies are on the rise

In their quest to bridge the gap between digital and physical, many retailers have opened hybrid platform stores. They have also implemented strategies to reduce physical interactions with and between customers as much as possible. This translates into solutions like BOPIS (buy online, pick up in-store) and contactless checkout. With lockers, customers can also pick up their online purchases in-store (or at partners in the case of Amazon), whenever they want. These innovations allow shoppers to avoid checkout, interactions with other customers and employees, and waiting in line.

Best Buy, for example, has turned a quarter of its U.S. stores into e-commerce platforms since the pandemic began to allow customers to pick up their orders in-store.

According to CEO Corie Barry, the conversion of the 250 locations has allowed the company to adapt to changing customer habits and improve online order processing efficiency.

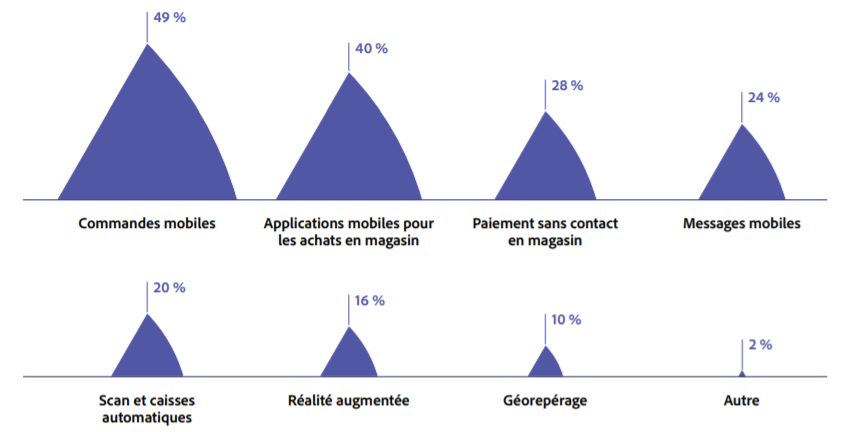

Retailers are focusing on the mobile experience

In addition to being a major source of direct sales, mobile is very often the starting point of an omnichannel journey that ends with an in-store visit or touchless checkout. According to the Adobe study, in November and December 2020, mobile traffic represented 60% of total traffic and 40% of sales in the United States. Its impact on the customer experience explains why multichannel retailers are devoting so much interest and spending to it. In fact, in 2021, retailers are investing in mobile ordering (49%) and mobile apps (40%).

Percentage of key mobile experience areas your company will invest in the most in 2021? (multi-channel retailers)

Due to shoppers' growing concern for their health, retailers have also leveraged mobile commerce to reduce human contact in-store. More than a quarter (28%) of multichannel retailers now make it one of their top two priorities. For example, with its Scan & Go app, Walmart has implemented a strategy that allows it to bring together different channels to create an integrated touchless customer experience via a streamlined checkout process. Shoppers locate scan and purchase items directly on their mobile device, avoiding lines and contact with split screens at checkout. With this type of app, salespeople are less engaged at checkout and more available to help in-store. The staff explains to customers how to buy online and provide an additional service, generating additional sales opportunities in-store.

The need for agility is growing

Store closures and product unavailability are driving customers to experiment with new shopping solutions. To adapt to these changing habits, brands must be agile. This study reveals that many retailers are meeting this challenge. More than half (57%) of retailers confirm that they were able to freely test new ideas and innovate in marketing in the second half of 2020. In addition, nearly four out of five retailers (79%) say they have been particularly agile and responsive. To make decisions quickly and maintain agility, retailers must have strong communication in place. This was especially true in 2020 when meeting sales targets was complicated by store closures. Just over two-thirds of retailers (68%) "agree" or "strongly agree" that they saw an excellent level of communication between teams in Q2 2020.

1. In a time of unprecedented upheaval, retailers must be agile

The upheaval initiated by the pandemic has pushed retailers traditionally slow to capitalize on emerging trends to be reactive. Current events are serving as a catalyst to innovate and transform organizational structures and processes that are no longer fit for purpose, enabling retailers to remain competitive or even just stay in business. Agile companies that are able to keep up with changing customer trends will increase revenues, strengthen customer relationships, and continue to reap incremental gains long after the pandemic is over.

2. Seize the opportunity to innovate via digital self-service and mobile experience

As customer behavior evolves, it is incumbent upon retailers to experiment with technologies that enable customer interactions through digital channels. Above all, consumers want to be able to shop with minimal exposure to other customers, whether at home via their computer or mobile device, or in-store with contactless technology. As we slowly emerge from the crisis, investing in digital self-service is critical to converting prospects into customers and customers into brand ambassadors. Improving self-service technology frees up staff time to engage with shoppers and focus on delivering winning customer experiences.

3. Omnichannel retailers must focus on hybrid strategies.

While the transition to e-commerce presents opportunities for brands, online retailing does not replicate every aspect of the physical customer journey, nor does it create the same conditions for building the close relationships necessary to create customer value. Multichannel retailers need to rethink the use of their physical stores to exploit other experiential marketing opportunities while implementing their transition to e-commerce platforms for in-store ordering and pickup.

Don't miss any news, subscribe now!

Related articles

Publications recommandées