Nissrine Fessikh

24-11-2021 6 min readOn the lookout for new Advertising Measures

Advertising measurement is in an unprecedented state of flux. For marketers, this means taking a less myopic view of campaign performance and being more proactive in measuring long-term effectiveness.

Brands will find it more difficult to access and analyze user-level data due to increased privacy regulations, Google's deprecation of third-party cookies (expected in 2023), and Apple's decision to require users to sign up for ad tracking through mobile apps. Initiatives such as Google's Federated Learning of Cohorts (FLoC) encourage analysis of audience groups rather than individuals. Daily online campaign measurement will require lower levels of granularity.

Television measurement is also at a crossroads, after Nielsen's longstanding accreditation to measure national and local television in the US was suspended by the Media Rating Council. The rapid growth of connected TV viewing means that the industry must find a way to reconcile traditional panel ratings with digital impression data.

For some marketers - particularly those with direct customer relationships - the solution to the impending third-party data crisis will be to double down on first-party data collection.

39% of respondents to the Marketer's Toolkit 2022 survey believe that developing first or zero-party data assets is their best response to the demise of the third-party cookie.

Not all brands will find it possible to build large pools of first-party data, but 85% of respondents expect their businesses to be affected by data privacy restrictions, and more than half (56%) agreed that consumer profiling in an increasingly fragmented data environment is the biggest challenge for marketing in a post-cookie world.

For some brands, the new data environment will encourage exploration of the insights that can be gathered from probabilistic data collection and analysis. This provides an opportunity to adopt more holistic measurement solutions and bring together previously disconnected short and long-term effectiveness measures.

Solving the cross-channel navigation conundrum

The slowdown in third-party data is likely to lead to a blurring of the boundaries between short and long-term effectiveness measurement. This will have implications for brands in 2022.

Need for new measures and techniques

The future of measurement will require the integration of a range of solutions - and a coalition of collaborative partners - rather than a single tool.

More than half (53%) of those surveyed by WARC for the Marketer's Toolkit said they were looking for 'new measures of effectiveness, while 42% recognized the need to invest in new technologies to measure audiences.

UK Channel 4 recently reviewed its media planning and buying account, and the availability of measurement automation tools was a key factor in its selection.

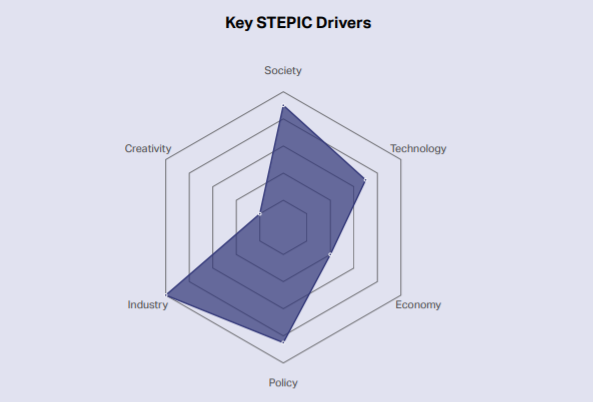

Industry: Brand dissatisfaction with existing measurement techniques is the main driver of this trend.

Society: Consumers are increasingly concerned about privacy and have pushed back against platforms.

Politics: Concerns expressed by regulators and politicians are also driving the trend.

Technology: Although clear solutions are not yet in place, the application of evolving technologies may also help accelerate this trend.

Rethinking long-term measurement

Thanks to developments in machine learning, measurement models such as Diageo's Marketing Catalyst become both strategic and tactical.

Marketing mix modeling (MMM) can be performed every few weeks, rather than quarterly or annually. Real-time models can be fed with estimates and benchmarks to enable real-time optimization. Even data-rich digital platforms such as Google and Facebook are prompting brands to reconsider models versus last-click attribution.

As a result, measuring long-term effectiveness is becoming a more active goal. Using artificial intelligence, this type of modeling can also explore future scenarios through 'war games. Advertisers can use these results to prepare for changes in consumer and competitor behavior.

Don't miss any news, subscribe now!

Related articles

Publications recommandées